Mortgage Rates Projected to Rise as Tapering Continues

It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established.

However, in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering:

“In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.”

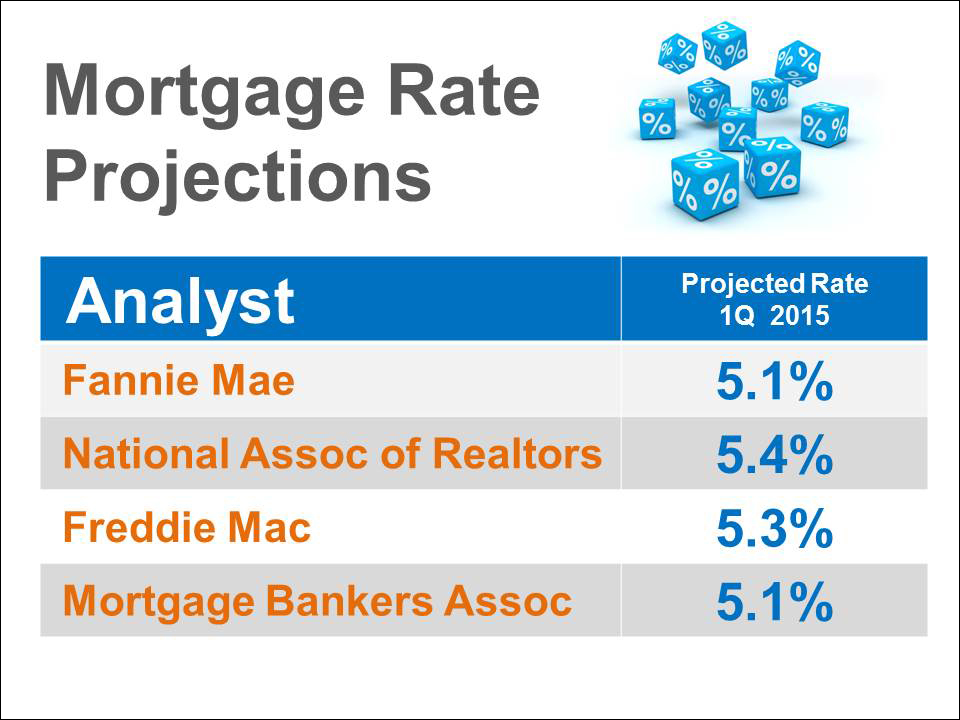

What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year:

* Reported from Keeping Current Matters Blog

Housing affordability is over 180, an all-time high when 100 is considered good and you're still renting. Really? Are you waiting for it to get to 200? Do you think prices and rates are going to get lower? Really?

Housing affordability is over 180, an all-time high when 100 is considered good and you're still renting. Really? Are you waiting for it to get to 200? Do you think prices and rates are going to get lower? Really?