Buying a Home...the Cost of Waiting...

A terrific article we found from the authors of "Keeping Current Matters." This article explains the costs of waiting to buy a home in today's real estate market.

Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

PRICES

Over 100 economists, real estate experts and investment & market strategists wererecently surveyed. They were asked to project where home prices were headed. The average value appreciation projected over the next twelve month period was approximately 4%.

MORTGAGE INTEREST RATES

In their last Economic & Housing Market Outlook, Freddie Mac predicted that 30 year fixed mortgage rates would be 4.8% by this time next year. As of last week, the Freddie Mac rate was 4.14%.

What does this mean to you?

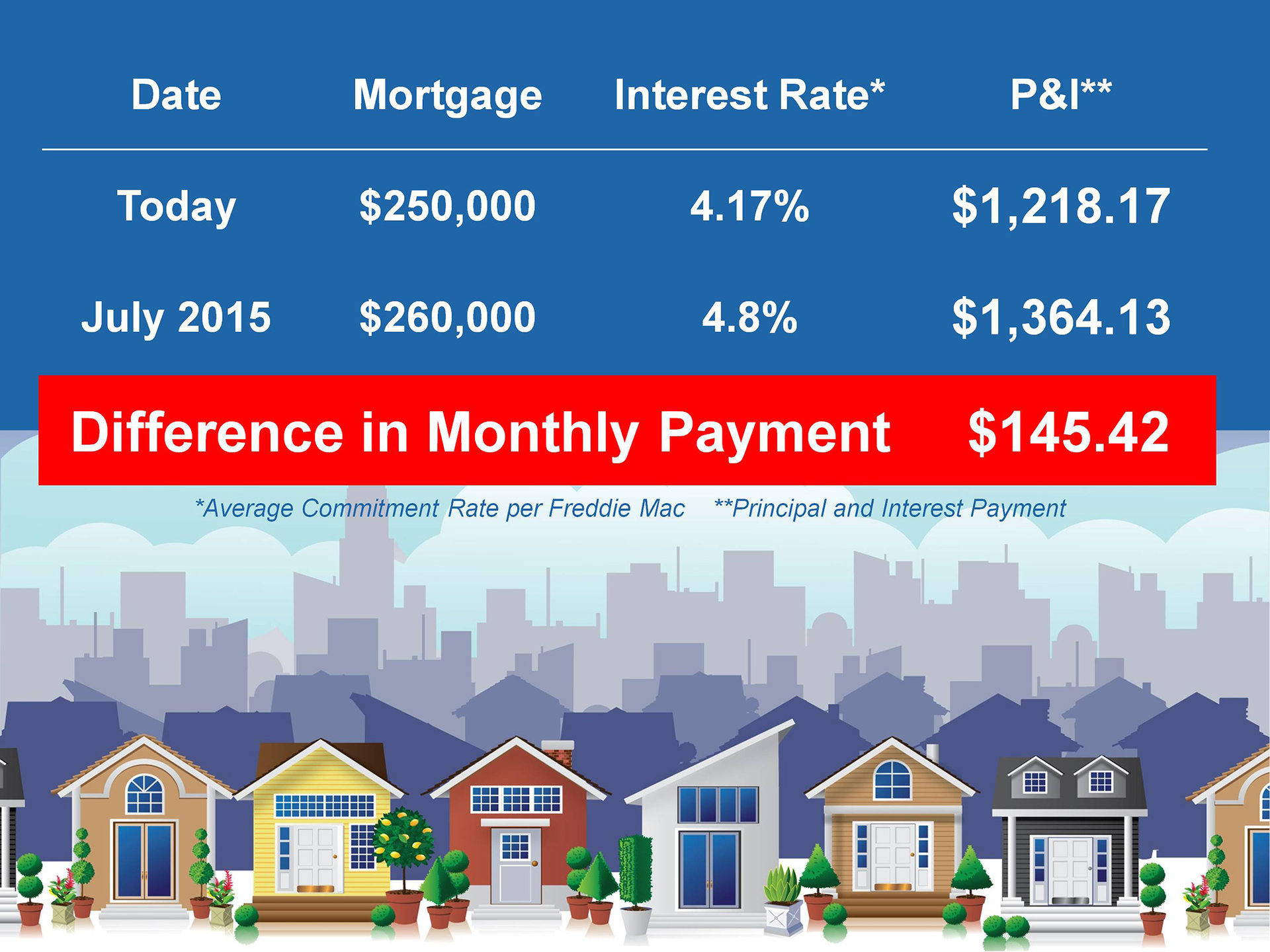

If you are a first time buyer currently looking at a home priced at $250,000, this is what it could cost you on a monthly basis if you wait to buy next year:

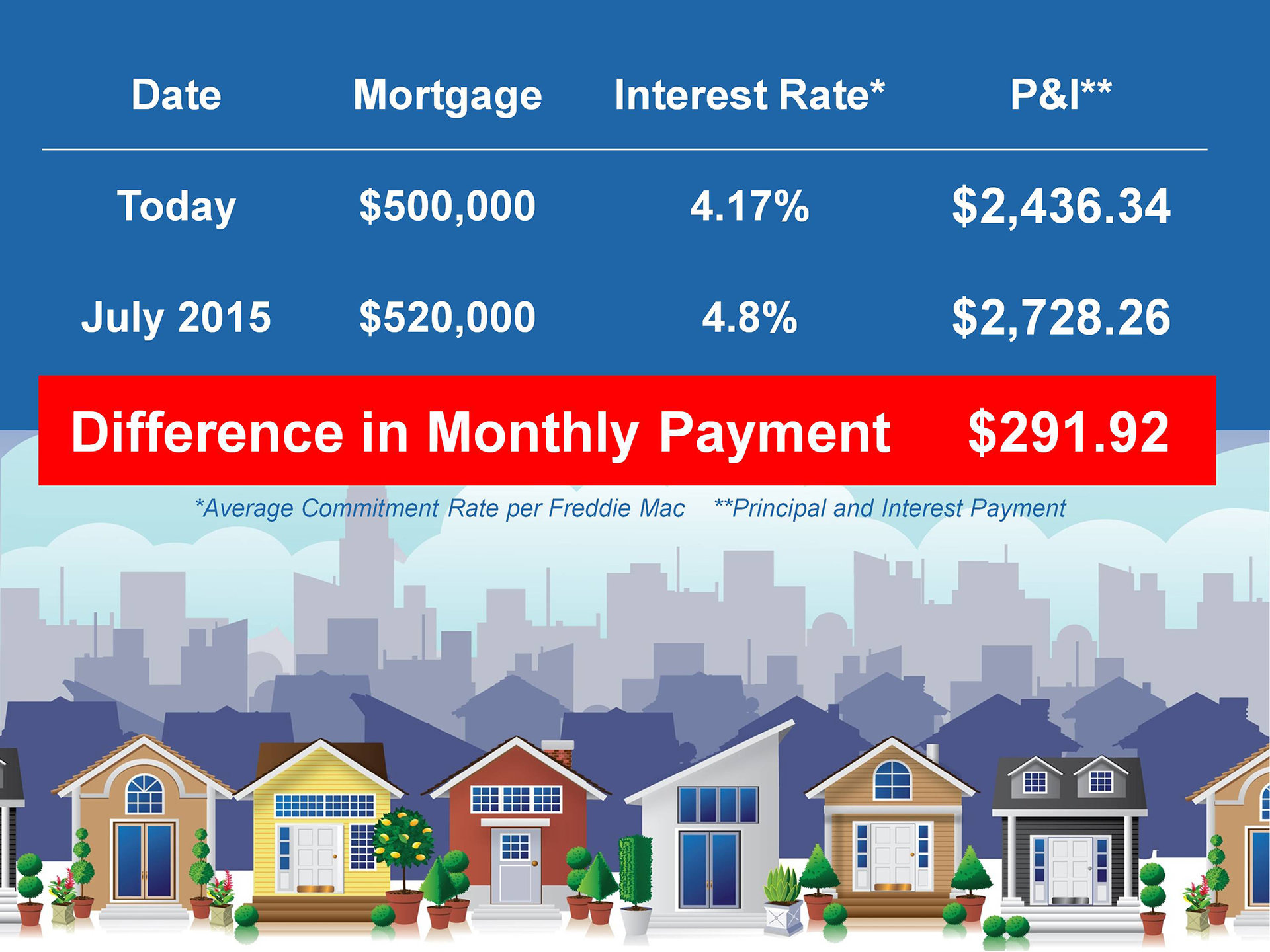

If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait to buy next year:

Bottom Line

With both home prices and interest rates projected to increase, buying now instead of later might make sense.

If you are looking to buy or know someone who is, please contact The Mike Parker Team today.