44 Times More Than a Renter

The Federal Reserve Board's Triennial Survey of Consumer Finances recently revealed the net worth of a homeowner was $231,400 compared to $5,200 for a renter. The net worth of homeowners increased 15% from 2013 to 2016 while renters' decreased by 5%.

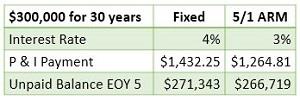

Appreciation and principal reduction are the two dynamics that affect a homeowner's equity. Each payment is applied to the interest for the previous month and the principal reduction to retire the mortgage.

A $300,000 home purchased with a $294,566 FHA mortgage at 5% for 30 years has an average monthly principal reduction $362 in the first year. Two percent appreciation would benefit the buyer by $500 a month. In this example, the equity grows by $860 a month for the homeowner. A tenant would have to invest $660 a month over and above the rent they're paying.

Based on the assumptions listed above, the $10,500 down payment would become approximately $85,000 of equity in seven years.Leverage and forced savings contribute to the difference in addition to the appreciation and principal reduction.

The rent paid by tenants help the landlord recoup their investment in the home and a return on their investment. Some people say, regardless if a person rents or buys, they pay for the house they occupy. The choice is whether to buy it for themselves or their landlord.

Check out some of the benefits using your own numbers with this fill-in-the blank Rent vs. Own.

throughout the tenure in their home. This experience far exceeds personal experience because of the day-to-day activities working in the industry.

throughout the tenure in their home. This experience far exceeds personal experience because of the day-to-day activities working in the industry.