Low Inventories Indicate a Trend

Low Inventories Indicate a Trend

Low inventory is a relative term depending on how you're comparing it. Would the comparison be to total number of homes on the market last year, homes in a certain price range or homes in a certain area? In some situations, it's a combination of all of those things.

|

|

In any given market, inventories will fluctuate based on area and price range. The National Association of REALTORS® considers a balanced market to be six months' supply of homes. If it takes longer than six months to sell, it is thought to be a buyer's market and less than six months, a seller's market. Most buyers and sellers probably feel inventory equilibrium is more like three month's supply of homes.

Inventory has a direct impact on price. During the housing bubble, demand decreased, supply ballooned to four million houses and prices dropped dramatically. Increased inventories due to foreclosures, bank' revised lending practices and builder's lack of new housing starts each contributed to the dramatically lower prices.

As the market has recovered, economic conditions have improved, banks have loosened their requirements, interest rates have remained low, foreclosures have slowed and gradually, the inventory has been reduced to approximately two million houses. When demand is constant but inventory is reduced, price tends to increase because the same number of people are trying to buy a smaller than normal number of homes.

Based on the low mortgage rates that have been inching up each week in 2013 and an improving consumer confidence level, most markets are experiencing some increase in demand. With inventory decreasing, buyers in the marketplace can see that prices are increasing.

Just as signs of spring can be seen to be just around the corner, it should be recognized what direction prices will be moving. Hindsight is 20/20 but we can't purchase or sell in the past. We need to make decisions today on what we think will happen in the future.

If you're curious to know what inventory conditions are for your specific market, send me an email with the price range and area and I'll send you a report. Mike@MikeParker.com

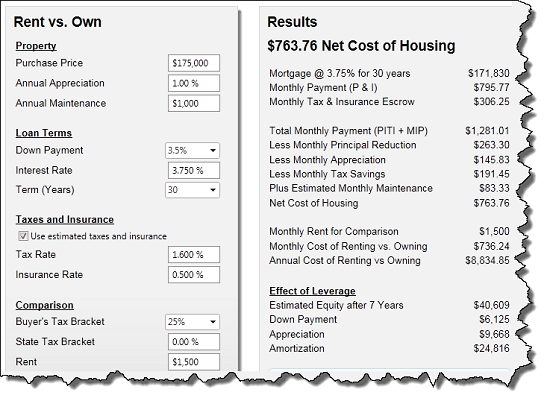

Housing affordability is over 180, an all-time high when 100 is considered good and you're still renting. Really? Are you waiting for it to get to 200? Do you think prices and rates are going to get lower? Really?

Housing affordability is over 180, an all-time high when 100 is considered good and you're still renting. Really? Are you waiting for it to get to 200? Do you think prices and rates are going to get lower? Really?