Article Written by Ben Rooney - CNN Money.com staff writer:

NEW YORK (CNNMoney.com) -- An index of homes under contract for sale fell more than expected in February, reaching the lowest level since the index's 2001 debut, according to a report released Tuesday.

The National Association of Realtors' (NAR) Pending Home Sales Index fell to 84.6 in February, down 1.9% from a revised reading of 86.2 in January and down 21.4% versus the same period last year.

Economists were expecting the index to decline to 85.2 for the month, according to a consensus estimate compiled by Briefing.com.

"The slip in pending home sales implies we're not out of the woods yet," said Lawrence Yun, NAR chief economist, in a statement.

The Pending Home Sales Index is considered a more forward-looking indicator of home sales than the NAR's more closely watched existing home sales report, which tracks sales at the time of closing, typically a month or two after a sales contract is signed.

The Pending Home Sales index was launched in 2001, and a reading of 100 is equal to results that first year. Before the housing market began to deteriorate last summer, the steepest decline in the index's history came in September 2001, when the 9/11 terrorist attack sent the index down to 89.8.

The Realtors revised their forecast slightly for existing home sales, projecting first-quarter existing home sales to decline 23.1% versus the same period last year after saying in March they would decline 23.2%.

For the full year, the NAR predicted existing home sales to be 4.7% lower than in 2007, after saying in March they would be down 4.8%.

Existing home sales for March will be released April 22.

"February was another poor month for housing, with pending sales down in most of the country," said Mike Larson, a real estate analyst at Weiss Research.

Larson thinks tight lending standards and the absence of speculative buying are to blame for the weakness in the housing market.

The NAR also lowered its forecasts for first-quarter and full-year real GDP growth, the broadest measure of the nation's economic strength. It also cut its expectations for nonfarm job growth in the first-quarter and full-year periods.

Yun thinks that the economy will not grow in first half of the year, but he is optimistic about the second half.

"The combination of recent fiscal stimulus enactment and the lagged impact of monetary policy will help jump start the economy in the second half."

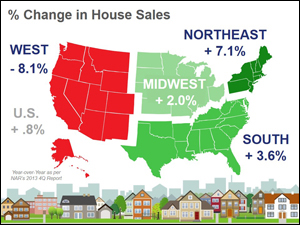

Some industry gurus are questioning whether the housing momentum we saw early in 2013 began to dissipate later in the year. The more dramatic have claimed the housing sector is still on shaky ground. Others have blamed the slowdown in sales on a lack of consumer confidence or rising interest rates.

Some industry gurus are questioning whether the housing momentum we saw early in 2013 began to dissipate later in the year. The more dramatic have claimed the housing sector is still on shaky ground. Others have blamed the slowdown in sales on a lack of consumer confidence or rising interest rates.